Robust Hiring of IT Pros in first quarter of 2022

published in our CIO - IT Manager Newsletter

Janco Forecast 130K -124K jobs to be adding in CY 2022

Hiring of IT Pros moves along at a brisk pace - Salaries are rising dramatically

Latest YTD IT job market data - Subscribe to our Newsletter to get this information delivered to your inbox as soon as it is released. SUBSCRIBE

This was initially published in our CIO - IT Management Newsletter. Charts below are all updated automatically with the latest data as it is released by the BLS and analyzed by Janco.

IT Job Market Continues to Shrink - AI Impacts IT Pros

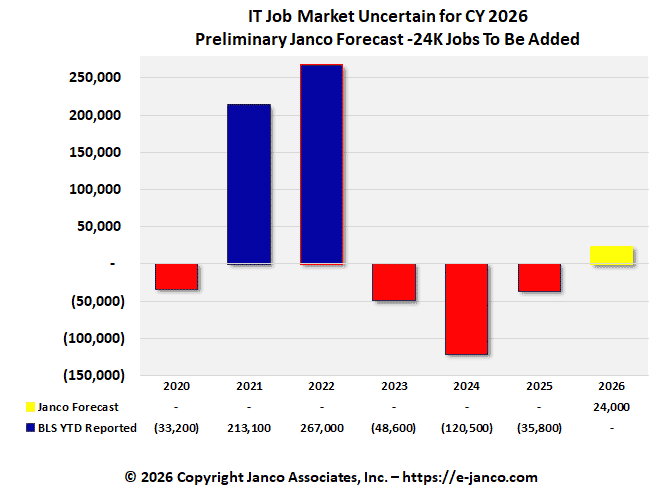

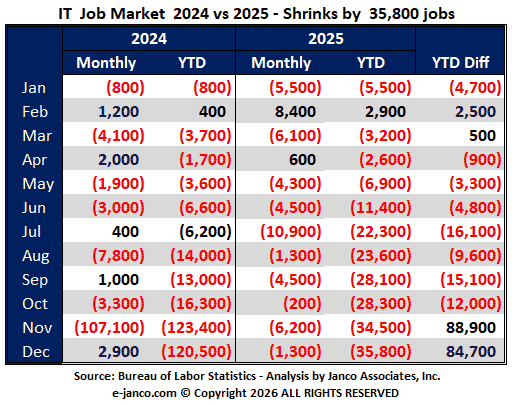

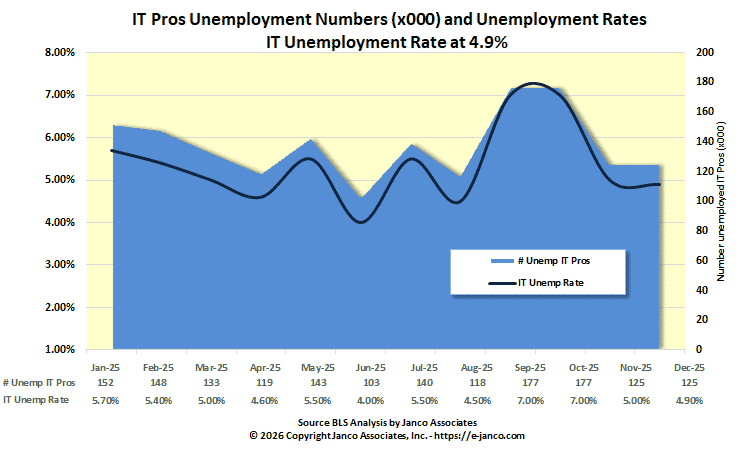

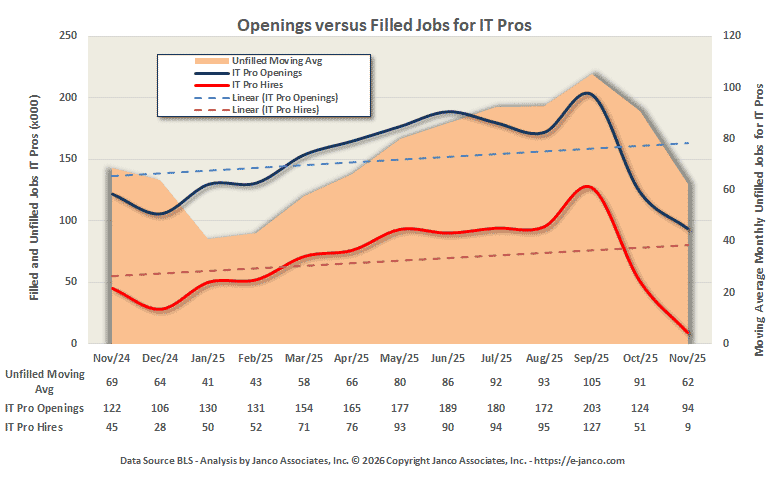

There are approximately 125K unemployed IT Professionals. The IT job market shrank by over 200K jobs in the prior 24 months. Overall that is a flattening of the long-term growth rate pattern of the IT job market. Based on our data and forecast models, the IT Job Market will improve in CY 2026.

Data complied and forecast updated by Janco Associates with data as of January 2026

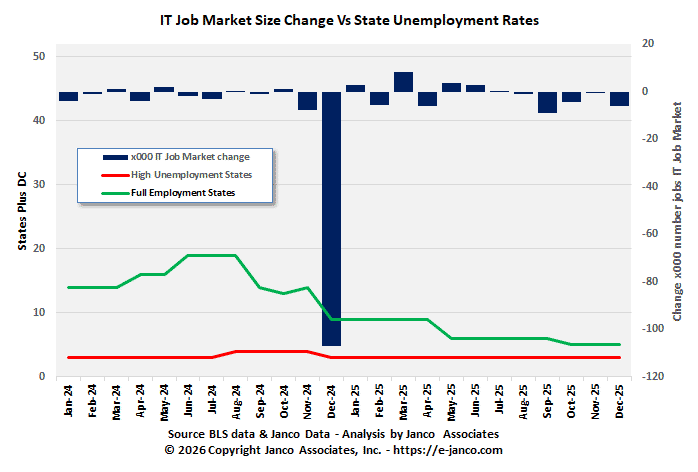

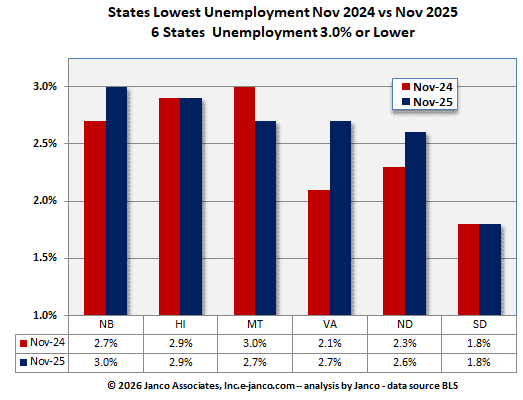

The current long-term trend is the IT Job Market will be impacted by individual state unemployment rates. The employment of IT professionals traditionally is tied to the national unemployment rates, but individual high tech states’ rates have a more significant impact. In our research, we have found that the number of IT jobs created or lost is tied to the number of high-tech states that are at full employment (3.0% or less) versus those with high unemployment rates (5.0% or higher.

IT Unemployment Rate 7.0% versus a national unemployment rate at 4.4%

First signs of a poor employment picture are appearing in the IT job market - Demand still high for experienced CIOs and CTOs in large enterprises.

There are Six (6) Full Employment States

Latest data

There still is a lot of uncertainty about the prospects for the US recovery. Inflation, the high cost of energy, the long-term impact of the war in Ukraine, and the political uncertainty caused by consumer confidence and presidential approval rates. Some say that inflation has peaked and others say that inflation will get to the low teens by the end of the year. It is our belief that inflation will continue until public policy and Fed money management are changed.

All of those factors will impact the long-term prospects for growth of the IT Job Market. We have interviewed a number of top IT executives and some of them are starting to re-think their current hiring plans. If the US has a downturn they do not have to face the prospects of having to cut staff. They view that as a negative on their enterprise’s reputations.

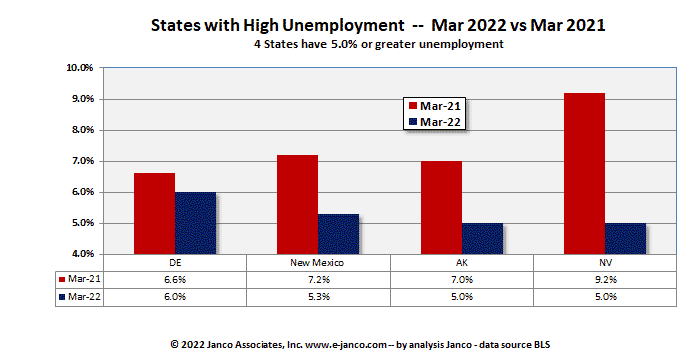

High Unemployment States

The highest unemployment states are those that have an overall unemployment rate of 5.0% or higher. In February there were four (4) states with unemployment rates of 5.0% or higher. The highest unemployment rates in January Delaware - 6.1%; New Mexico - 5.6%; California - 5.4%; and Alaska - 5.4%. Because of BLS adjustments, in March, California fell out of this class and Nevada moved in. The impact of the Covid shutdowns can be seen in the comparison of the unemployment rates with the same month of the prior year during the shutdowns. If there is a downturn, the question is whether unemployment rates spike up and in which states.

The year-to-year comparison of high unemployment states shows how quickly the unemployment rate can change in individual states. Nevada is a perfect example.

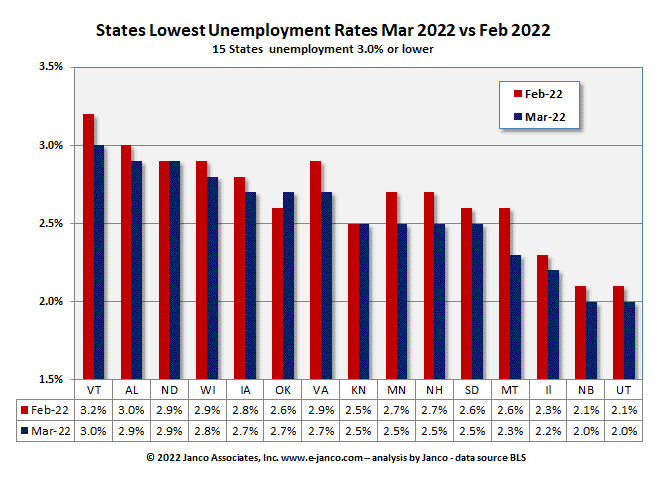

States with the Lowest Unemployment -- Full Employment States

State unemployment rates continue to improve. At the start of the shutdown, there were 14 states with unemployment rates of less than 3.5%.

In March the 15 states with unemployment rates 3.0% or less) were - Vermont (3.0); Alabama (2.9%); North Dakota (2.9%); Wisconsin (2.8%); Iowa (2.7%); Oklahoma (2.7%); Virginia (2.7%); Kentucky (2.5%); Minnesota (2.5%); New Hampshire (2.5%); South Dakota (2.5%);Montana (2.5%); Illinois (2.2%); Nebraska (2.0%); and Utah (2.0%).

In the states that are at full employment levels, only Utah, Virginia, and Illinois have a large base of jobs in the IT job market. Though the states like California, Massachusetts, and Texas are not at full employment levels they would be the first to be impacted if a downturn occurred in the US.

Looking at the year-to-year comparison, only Utah, based on our historical analysis, was not severely impacted by the shutdowns and should be able to weather a recession the best. That is not the case on either coast.

In our preliminary analysis, IT salaries for the Mid-Year salary survey show a rapid increase in compensation for new hires. In addition, many CIOs are starting to give pay raises to the existing staff at the 8 to 10% level.

Read on Salary Survey Order Salary Survey Download Summary